Crypto Market Pulse: October 2025

October 2025 marked one of the most turbulent periods for cryptocurrency markets in recent years, defying historical seasonal expectations. Following strong early-month performance, a significant "black swan" event on October 11 triggered an epic market correction, resulting in approximately $19bn in leveraged position liquidations across global markets. Given the ongoing U.S. government shutdown and persistent ecosystem vulnerabilities highlighted by frequent on-chain exploits, we believe near-term uncertainty will continue to dominate the crypto market.

Market Performance Overview: A Divergence from Seasonal Norms

October 2025 presented a stark contradiction to the traditional "Uptober" seasonal strength historically observed in cryptocurrency markets. The month delivered the worst October performance for Bitcoin since 2014, primarily driven by escalating trade tensions between the United States and China, compounded by shifting Federal Reserve rate-cut expectations. Cryptocurrency assets demonstrated initial strength in early October, supported by elevated market sentiment and structural product proliferation, but subsequently experienced retracement following the October 11 liquidation cascade.

Figure 1. BTC Monthly Return

Source: Coinglass, MicroBit, as of 31 Oct, 2025

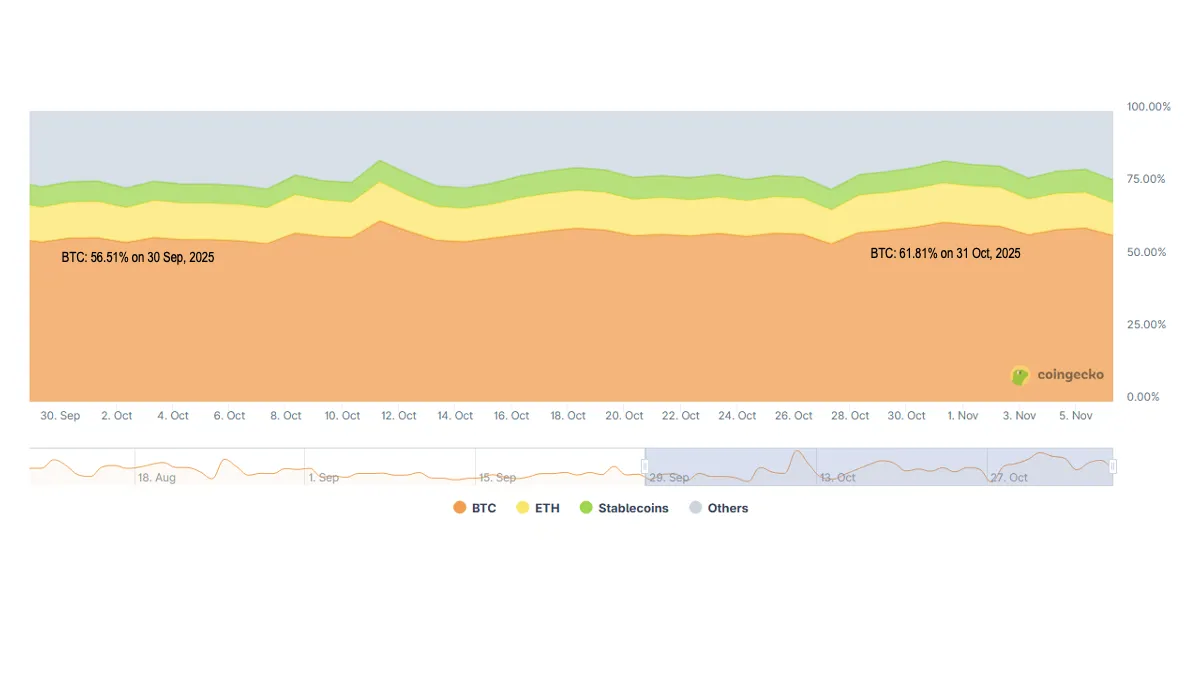

The magnitude of price deterioration extended across the digital asset ecosystem with significant differentiation by asset class. Bitcoin, despite maintaining its dominant position with its share edging up from 56.5% to 61.8% in October, plunged more than 16% from its highs to around $105,000. Ether's performance mirrored Bitcoin's weakness with proportionally larger percentage losses of over 20% from its monthly peak of $4,700, indicative of enhanced volatility in alternative layer-1 assets. Lower-liquidity altcoins experienced more extreme volatility, with certain illiquid tokens approaching near-zero valuations.

Figure 2. BTC Dominance Chart

Source: Coingecko, MicroBit, as of 5 Nov, 2025

Figure 3. BTC Price Change

Source: Coingecko, MicroBit, as of 5 Nov, 2025

Figure 4. ETH Price Change

Source: Coingecko, MicroBit, as of 5 Nov, 2025

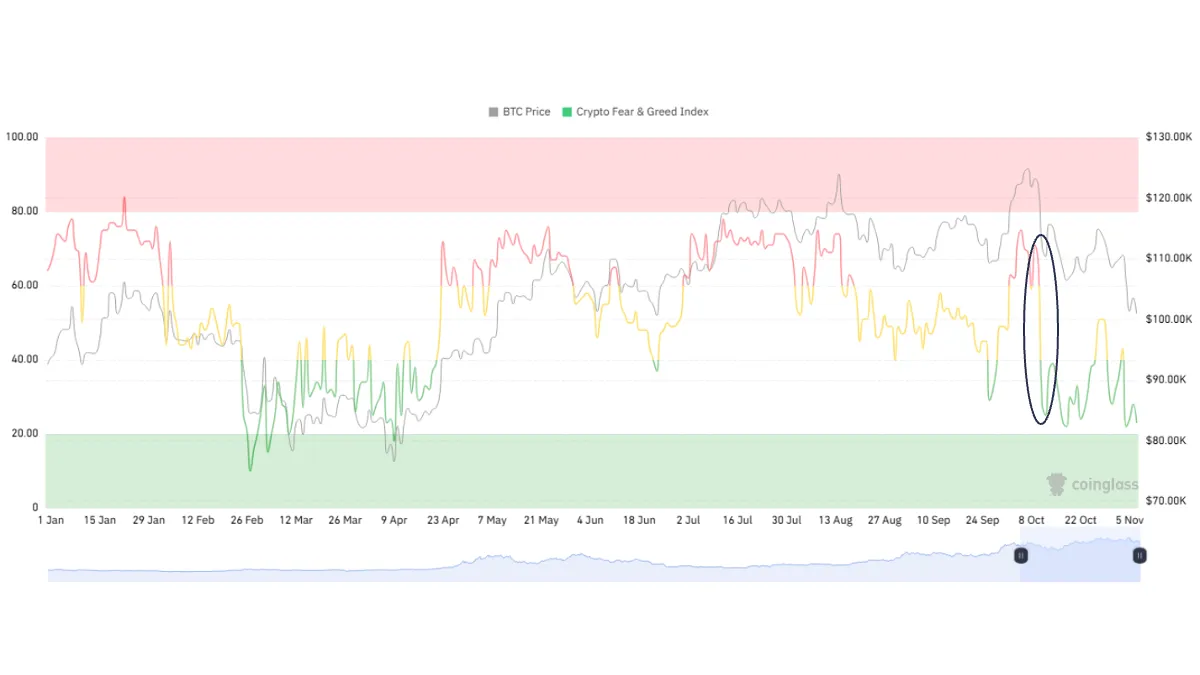

Market Sentiment: Macro Shocks and Structural Fragility

In October 2025, Bitcoin market sentiment was predominantly characterized by caution and fear, as investors adopted a wait-and-see approach following extreme volatility. The market turmoil began when Trump's tariff threats triggered a global sell-off of risk assets, exposing the crypto market's overleveraged positions. Combined with a breakdown in market maker liquidity mechanisms, this sparked a cascade of liquidation. Bitcoin experienced a historic flash crash, liquidating over 1.6 million traders within 24 hours and spreading widespread panic.

Figure 5. Crypto Fear & Greed Index in 2025

Source: Coinglass, MicroBit, as of 5 Nov, 2025

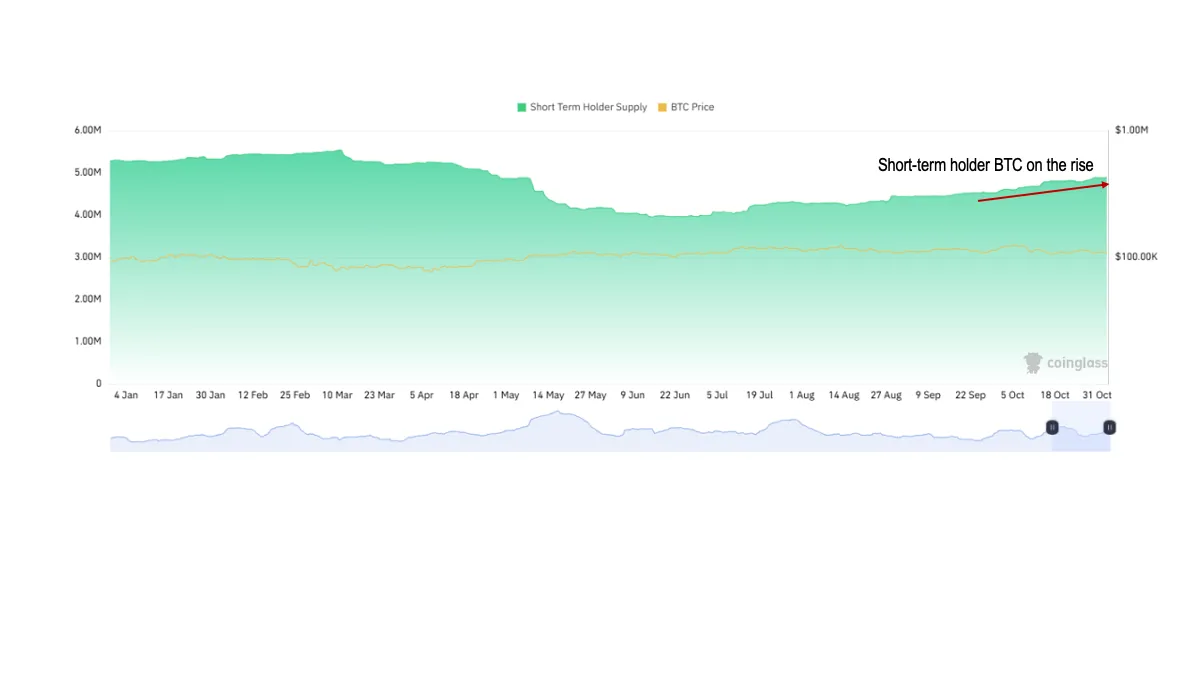

The market entered a phase of volatile consolidation, reflecting persistent investor concerns over macroeconomic policy uncertainty such as diminishing expectations for Fed rate cut and structural vulnerabilities within the crypto market. On-chain metrics revealed notable accumulation by short-term holders, preceding market corrections and potential selloffs. While this selling pressure has exacerbated recent declines, the flushing out of speculative participants may ultimately lay a more stable foundation for the next phase of recovery.

Figure 6. BTC Short-term Holder Supply

Source: Coinglass, MicroBit, as of 31 Oct, 2025

ETF Dynamics: Capital Rotation and Product Expansion

In October 2025, the crypto ETF market demonstrated a strong rebound. According to Binance, BTC spot ETFs recorded cumulative net inflows of $4.2bn during the month, fully reversing September's outflow trend of $1.2bn. Assets under management (AUM) reached $178.2bn, accounting for 6.8% of BTC's total market capitalization. In contrast, ETH ETFs witnessed $555m in net outflows during October. This capital shift drove the first consecutive monthly outflow since April of this year, highlighting a distinct rotation away from the asset.

In October 2025, newly launched ETFs primarily focused on diversifying underlying crypto assets. Markets in the United States and Hong Kong introduced a range of spot and staking-enabled ETFs covering assets such as Solana, Litecoin, and Hedera. Product offerings expanded from single-asset to basket and derivatives-based structures, with certain ETFs incorporating staking reward mechanisms. Furthermore, many of these new ETFs were actively managed, featuring dynamic weight adjustments to enhance asset diversification and risk control.

Future Outlook

We anticipate market uncertainty will continue to dominate sentiment in the short term, weighed down by the prolonged US government shutdown and potential losses from hacker attacks. A decisive market turnaround hinges on the cessation of this political impasse and the advancement of key legislation like the US Market Structure bills.

In the long run, the sustained growth trajectory of crypto assets is underpinned by three established and enduring trends: (i) ongoing regulatory maturation, evidenced by Hong Kong’s open approach to global liquidity and U.S. moves toward statutory clarity; (ii) steadily accelerating institutional participation, with major asset managers endorsing allocation to digital assets; and (iii) the persistent expansion of blockchain’s use cases through real-world asset tokenization and stablecoin adoption.

Disclaimers

This material is produced by MicroBit Capital Management Limited ("MicroBit") and is intended for Hong Kong investors only. All content is for general information purposes and does not constitute an offer, solicitation, or recommendation to buy or sell any financial instruments, nor is it legal, financial, tax, or investment advice.

Investments involve risks. The value of investments can go up or down, and investors may lose some or all of their invested capital. Past performance is not a guarantee of future results. You should carefully consider your investment objectives and risk tolerance and seek advice from a professional financial advisor before making any investment decisions.

MicroBit does not guarantee the accuracy, timeliness, completeness, or reliability of the information provided. All materials are presented “as is”, without any warranties of any kind, whether express or implied, including but not limited to merchantability, fitness for a particular purpose, or non-infringement. Unless otherwise specified, some of the views and recommendations are compiled by MicroBit based on publicly available data and market experience.

Securities and Futures Commission (SFC) authorization is not a recommendation or endorsement of a scheme, nor does it guarantee its commercial merits or performance. This material has not been reviewed by the SFC. Copyright © 2025 MicroBit Capital Management Limited. All rights reserved.