Geopolitical tensions have escalated between Europe and the U.S. after U.S. President Donald Trump announced tariffs on European countries over Greenland on 17 January 2026. This has driven investors toward safe-haven assets amid rising risk aversion, as Europe considers retaliatory measures against the tariff threat, sending gold surging to record highs.

Will gold’s outperformance last year continue in 2026? Beyond geopolitical dynamics, what other key factors are supporting gold? Read on to uncover the key drivers behind gold's momentum and what lies ahead for investors in 2026.

Remarkable Year of Gold in 2025: What was behind?

In 2025, gold delivered a remarkable performance, repeatedly reaching new all-time highs and achieving a cumulative annual gain of c.65%. This upward trend was primarily driven by heightened geopolitical uncertainty, intermittent U.S. dollar weakness, and record-high central bank gold purchases (Figure. 1). Looking ahead to 2026, gold prices are likely to experience wide fluctuations at elevated levels, with potential for further upside under specific macroeconomic scenarios. Key supporting factors include persistent geopolitical and systemic risk premiums, evolving U.S. dollar dynamics, and sustained allocation by both official and institutional investors.

Figure 1. Main Drivers for Gold Price Rise from Uncertainties, weaker US Dollar and Explosive Investment Demand

Source: Bloomberg, World Gold Council, data as of 31 December 2025.

The "Textbook-Defying" Interest Rate–Gold Relationship in 2025

Over the long term, gold has traditionally served as a hedge against inflation, typically exhibiting an inverse relationship with the U.S. dollar and real interest rates. However, the market dynamics in 2025 significantly deviated from this historical pattern: despite the Fed cutting interest rates by a cumulative 175bps, persistent inflation fueled by tariffs, energy prices, and fiscal expansion led to 51bps rise in real interest rates for the year (Figure. 2). Despite this environment, gold prices continued to set new records, indicating a structural decline in gold’s sensitivity to real rates (Figure. 3).

Figure 2. Unusual Real-interest Rate rise with Fed funds Cut

Source: Bloomberg, World Gold Council, data as of 31 December 2025.

Figure 3. Unexpected Gold Price rise along with Real-Interest Rate up

Source: CME Group, 7 January 2026.

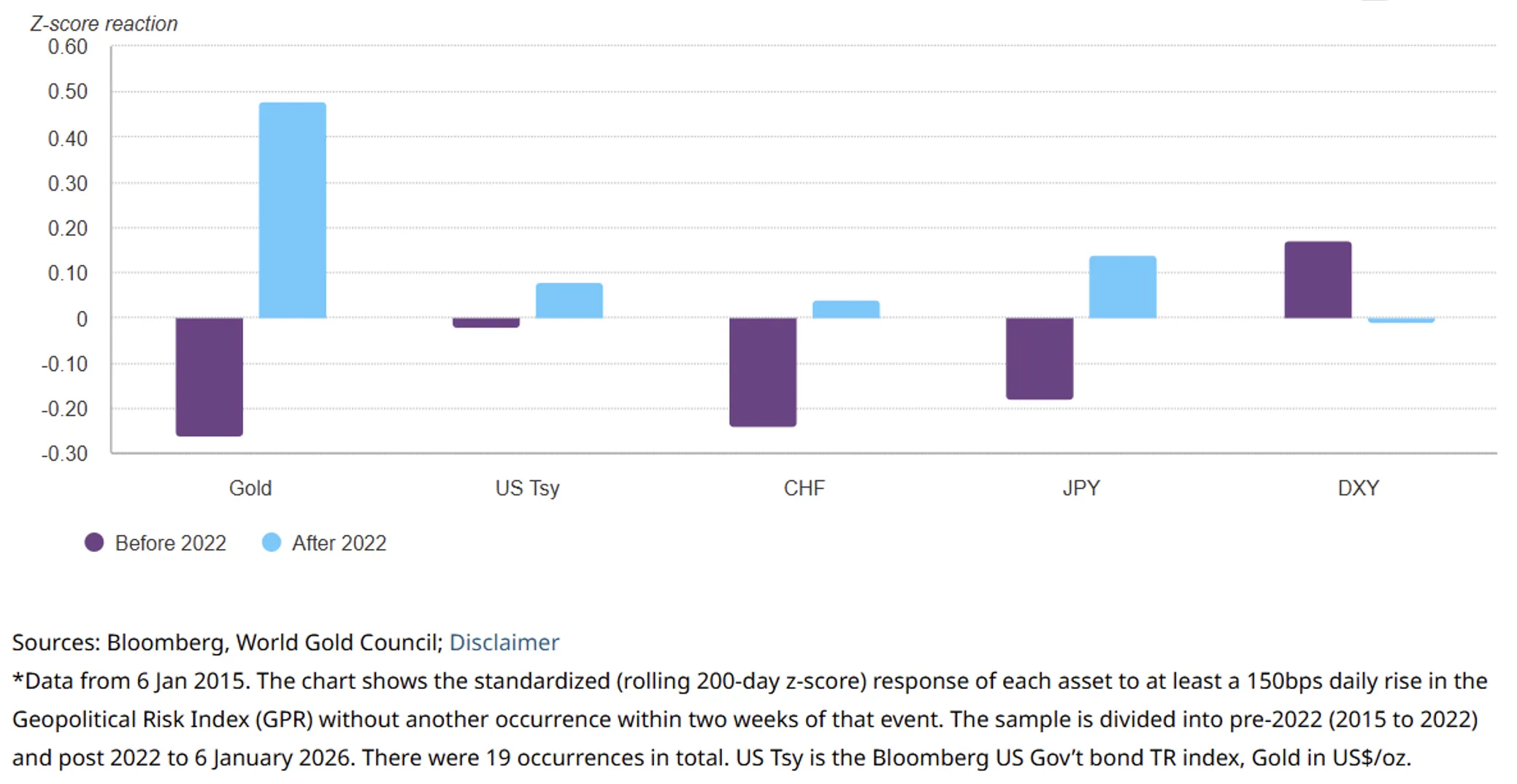

Near-Term Outlook: Range-Bound with Elevated Risk Premiums

From a tactical perspective, continued uncertainties in global growth and policy paths will support gold prices in 2026, with potential for further upside. Gold has increasingly become a preferred geopolitical hedge for central banks and sovereign institutions, particularly amid rising risks of conflicts, sanctions, and reserve freezes (Figure. 4). Key geopolitical flashpoints, including the trajectory of the Russia-Ukraine conflict, developments in Iran, U.S. policy toward Venezuela, and strategic competition over regions such as Greenland, lack clear resolution frameworks. Any escalation could quickly amplify concerns over energy and sovereign security, boosting gold’s geopolitical risk premium.

Figure 4. Gold Becomes the Geopolitical Safe-haven of Choice

Source: Bloomberg, World Gold Council, data as of 6 January 2026.

In addition, economic and institutional uncertainties are also mounting. Legal and political scrutiny over Fed independence, highlighted by potential criminal proceedings against Chair Powell and the Supreme Court case involving Governor Cook, has introduced unprecedented uncertainty into monetary policy governance. Markets are beginning to price in a scenario where policy becomes more politicized and long-term inflation and rate paths less predictable. Furthermore, should the Supreme Court affirm or expand the use of IEEPA-based tariffs and sanctions, the U.S. could more frequently deploy trade and financial restrictions, increasing volatility in global trade, currency markets, and inflation. Even in the absence of full implementation, the mere persistence of these risks underpins gold’s status as a hedge against institutional and policy uncertainty.

Long-Term Drivers: Structural Demand and Monetary Support

Gold prices are poised for a gradual yet sustained upward trajectory over the mid-to-long term, driven by a combination of favorable monetary policy conditions and deepening structural demand. With U.S. inflation moderating to 2.7% by December 2025 and the labor market softening, we expect the Fed to maintain an accommodative stance. With continuous rates cut, real interest rates may recede from recent highs, contributing to the reduction of opportunity cost of holding gold.

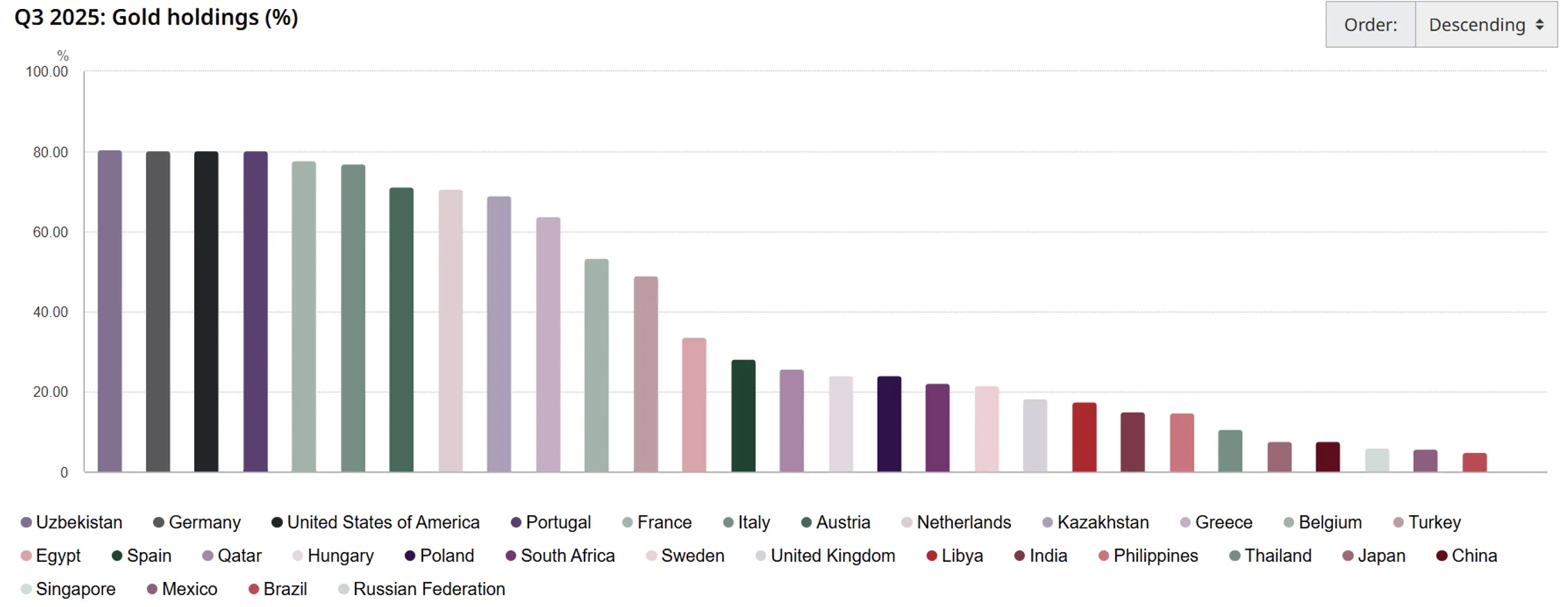

Gold is set to receive sustained structural support from both official and institutional demand. According to the World Gold Council, 95% of central banks surveyed in early 2025 intend to increase their gold reserves over the coming year. Notably, major emerging economies such as China, Brazil, and Mexico still hold gold reserves below 20% of their total reserves (Figure. 5). Research from the BIS in 2020 indicates that maintaining gold reserves above this threshold can significantly enhance currency risk resilience for commodity-exporting and emerging-market central banks, pointing to considerable latent demand.

Figure 5. Gold Holdings of Central Banks in Major Countries

Source: World Gold Council, data as of 30 September 2025.

Meanwhile, institutional and retail demand is also strengthening through supportive policy initiatives. In February 2025, China launched a pilot program allowing insurance funds to invest in gold, followed by India's approval for pension funds to invest in gold ETFs in December. These policy shifts across multiple regions are gradually unlocking structural demand, supporting a steady upward trajectory for gold prices in the mid-to-long term.

In summary, gold enters 2026 in a position of strength, having recently broken above the $4,600 per ounce threshold to reach new historic highs. This momentum is underpinned by a confluence of cyclical uncertainties and structural tailwinds. While elevated volatility is likely to persist amid shifting macroeconomic and geopolitical dynamics, the fundamental case for maintaining and selectively increasing strategic exposure to gold remains compelling for diversified portfolios.

Disclaimers

This material is produced by MicroBit Capital Management Limited ("MicroBit") and is intended for Hong Kong investors only. All content is for general information purposes and does not constitute an offer, solicitation, or recommendation to buy or sell any financial instruments, nor is it legal, financial, tax, or investment advice.

Investments involve risks. The value of investments can go up or down, and investors may lose some or all their invested capital. Past performance is not a guarantee of future results. You should carefully consider your investment objectives and risk tolerance and seek advice from a professional financial advisor before making any investment decisions.

MicroBit does not guarantee the accuracy, timeliness, completeness, or reliability of the information provided. All materials are presented “as is”, without any warranties of any kind, whether express or implied, including but not limited to merchantability, fitness for a particular purpose, or non-infringement. Unless otherwise specified, some of the views and recommendations are compiled by MicroBit based on publicly available data and market experience.

Securities and Futures Commission (SFC) authorization is not a recommendation or endorsement of a scheme, nor does it guarantee its commercial merits or performance. This material has not been reviewed by the SFC.

Copyright © 2025 MicroBit Capital Management Limited. All rights reserved.